ADA Price Prediction: How High Will It Go?

#ADA

- Bullish Technical Alignment: Price above the 20-day MA and a MACD that may be poised for a bullish crossover suggest building upward momentum, with the $0.50 Bollinger Band upper limit as the immediate target.

- Powerful Fundamental Catalysts: Strategic executive hiring, reaffirmed long-term vision from leadership, and its role in a broader market rally create a strong positive sentiment tailwind.

- Clear Risk/Reward Levels: The trading range is well-defined between $0.375 (strong support) and $0.503 (key resistance), providing a framework for evaluating price movement in the coming sessions.

ADA Price Prediction

ADA Technical Analysis: Bullish Momentum Building

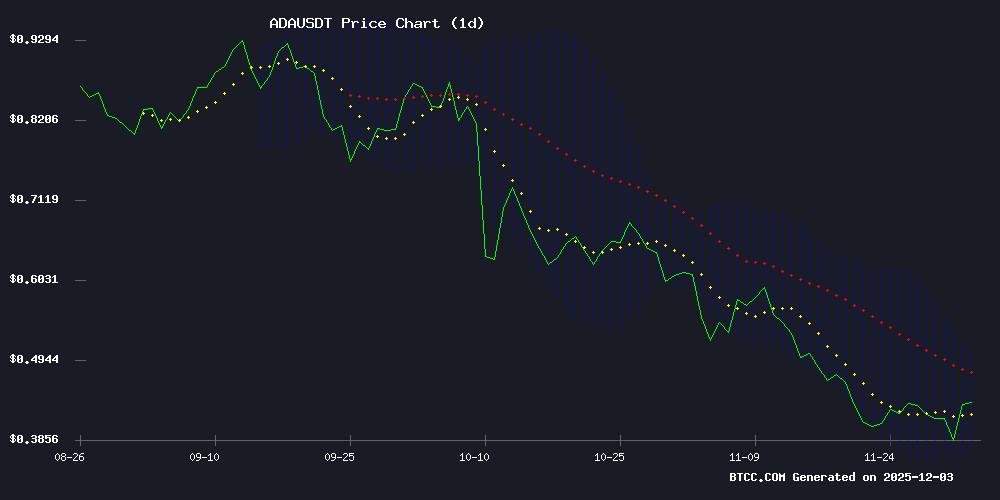

According to BTCC financial analyst James, ADA is showing promising technical signals as of December 4, 2025. The current price of $0.4501 sits above its 20-day moving average of $0.43914, suggesting underlying strength. The MACD indicator, while negative at -0.012875, shows its signal line (0.055527) above the MACD line (0.042653), which can be an early sign of potential bullish momentum building beneath the surface. The price is trading comfortably within the Bollinger Bands, with the middle band at $0.43914 acting as support. A decisive break above the upper band at $0.503243 WOULD be a strong bullish confirmation, opening the path toward the $0.50 resistance level that market participants are watching.

Positive Sentiment Fuels ADA's Ascent

BTCC financial analyst James notes that the news flow for Cardano is overwhelmingly positive, reinforcing the technical outlook. The appointment of a former Copper.co executive as CFO signals a mature focus on financial strategy and institutional growth. Furthermore, founder Charles Hoskinson's reaffirmation of the long-term vision provides fundamental confidence. Headlines highlighting Cardano leading a market rally and analysts signaling a potential market bottom create a powerful narrative of recovery and strength. While the '$1 Trillion Market Cap' projection is a highly speculative long-term scenario, it contributes to a bullish market sentiment that aligns with the technical target of challenging the $0.50 level.

Factors Influencing ADA’s Price

Cardano Appoints Ex-Copper.co Executive as CFO to Bolster Financial Strategy

The Cardano Foundation has named Stephen Wood, former Finance Director at Copper.co, as its new Chief Financial Officer. With two decades of experience in traditional finance, Wood will oversee treasury management, risk control, and ecosystem incentives—key pillars for Cardano’s long-term growth.

His appointment signals Cardano’s push to bridge crypto and institutional finance. Founder Frederik Gregaard emphasized Wood’s role in optimizing economic parameters and governance, leveraging his tenure at Verint and fintech disruptors.

Cardano Tests Key Technical Threshold as Bulls Target $0.50 Resistance

Cardano's ADA shows renewed bullish momentum, rebounding to test its 20-day simple moving average (SMA). The digital asset now faces a critical juncture—a decisive break above the upper Bollinger Band could signal continuation toward the $0.50 resistance level.

Trading near session highs, ADA demonstrates strong intraday demand. Market participants watch for sustained volume to confirm whether this technical recovery evolves into a broader trend reversal.

Cardano Leads Crypto Rally as Analysts Signal Market Bottom

Cardano (ADA) surged 14% in 24 hours, outpacing all top-10 cryptocurrencies as traders speculated the asset has found its floor. The rally to $0.445 follows weeks of sideways trading, with technical analysts now predicting a sustained uptrend.

Market observers note ADA's relative strength against Bitcoin suggests accumulating demand. The move coincides with broader crypto market gains, though Cardano's outperformance hints at asset-specific catalysts.

Cardano Founder Hoskinson Reaffirms Long-Term Vision for ADA

Charles Hoskinson, founder of Cardano, has doubled down on his bullish outlook for the blockchain project during a recent livestream. The Ethereum co-founder emphasized that development is progressing as planned, with ADA poised to become "the best and fastest" cryptocurrency.

Hoskinson outlined Cardano's roadmap, including potential cross-chain integrations that could expand its ecosystem. His comments come as the project continues to face scrutiny over its pace of development amidst a competitive layer-1 landscape.

Cardano's $1 Trillion Market Cap Scenario: Valuation Projections for ADA Holders

Long-term Cardano investors stand to gain substantially if ADA achieves a $1 trillion market capitalization, a milestone currently held exclusively by Bitcoin. At current valuations, a hypothetical 10,000 ADA position would undergo exponential revaluation under such market conditions.

The analysis underscores Cardano's potential to join Bitcoin in the ultra-elite tier of crypto assets, though such projections remain speculative. Market dynamics for proof-of-stake assets like ADA differ fundamentally from Bitcoin's scarcity model, requiring sustained institutional adoption to justify trillion-dollar valuations.

How High Will ADA Price Go?

Based on the current technical setup and supportive news sentiment, ADA has a clear path to test the significant $0.50 resistance level in the near term. The convergence of price trading above key moving averages, constructive positioning within the Bollinger Bands, and overwhelmingly positive fundamental developments create a favorable environment.

Key near-term levels to watch are:

| Level | Price (USDT) | Significance |

|---|---|---|

| Immediate Resistance | 0.503243 | Bollinger Band Upper Boundary |

| Key Psychological Resistance | 0.5000 | Major Round Number & Bull Target |

| Current Support | 0.43914 | 20-Day Moving Average & Bollinger Middle Band |

| Stronger Support | 0.375037 | Bollinger Band Lower Boundary |

A sustained break and close above $0.503 could trigger a stronger bullish phase. However, a failure to hold the 20-day MA support could see a retest of the lower Bollinger Band. The appointment of a seasoned CFO and strong leadership vision provide a fundamental floor that makes severe downside less likely in the current climate.